There’s no denying that climate change is one of the most pressing issues of our time. The recent Intergovernmental Panel of Climate Change (IPCC) report paints a very disturbing picture that buttresses this point. According to the body, the global temperature is poised to rise to 1.5°C within the next 20 years. In truth, the effects are glaring enough, from rising sea levels that result in flooding to frequent wildfires to heat waves.

Unfortunately, not many people understand the gravity of climate change, and fewer still are doing something about it. Perhaps, that’s why home insurance companies in California and beyond are doing their best to educate their clients, most of whom are homeowners, on the risk that this phenomenon poses to them and the steps to prepare for what is to come.

So, if you’re wondering what happens to your home after a flood or wildfire, if an insurance policy would save you from financial loss, or what are the best homeowners insurance companies in California for 2022, keep reading to get the right answers.

Are All Climate Changes Negative?

A common misconception among the general public is that climate change connotes doom and gloom, so to speak. The truth, however, is that not all climate changes that occur are negative. In fact, some are quite beneficial. For example, the change in temperature results in more rainfall during rainy seasons. In some parts of the world, such as the North Atlantic, precipitation is actually predicted to increase.

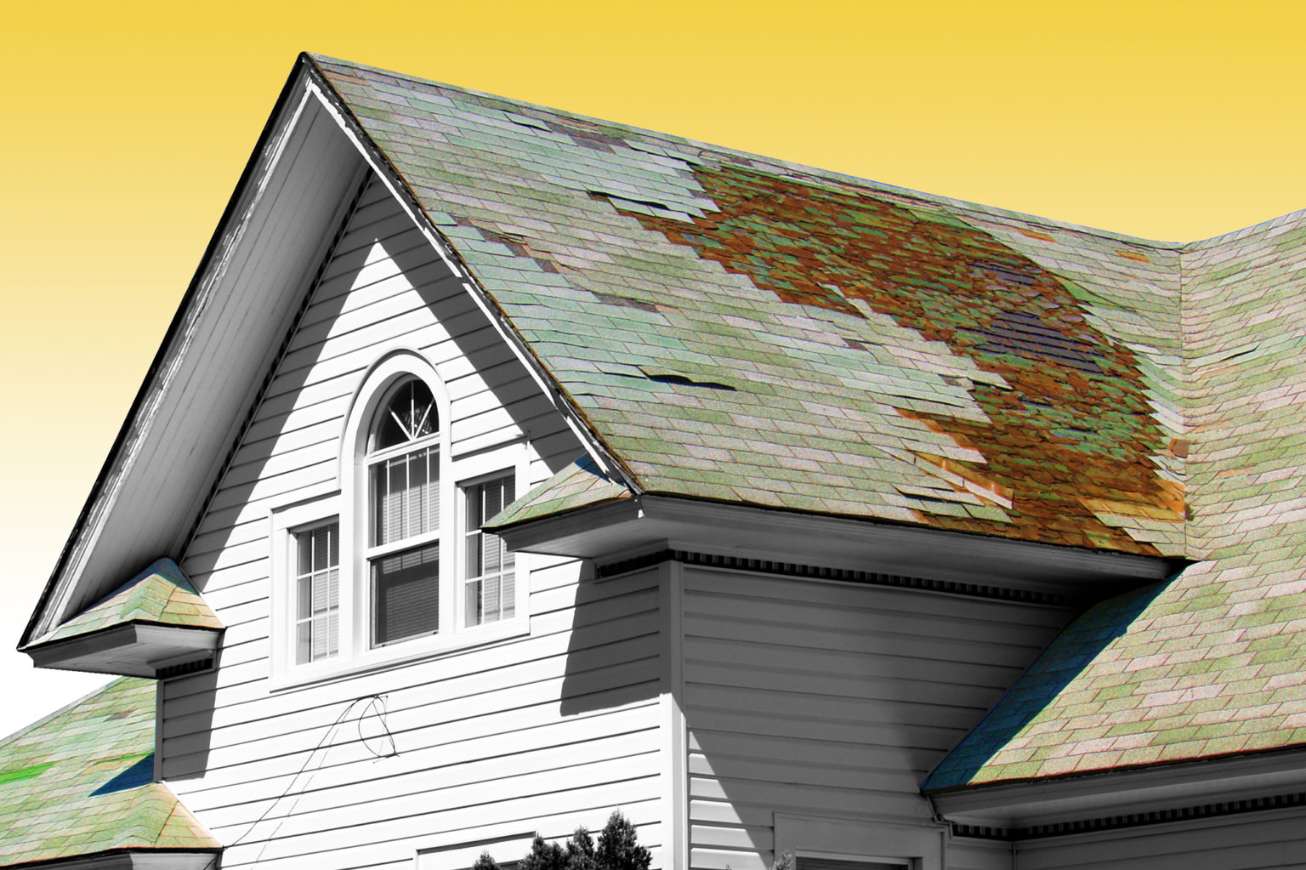

When it comes to the effects of climate change in California, the scales are heavily tipped in favour of the cons. Take fires, for instance, which now seem to be more destructive than ever. According to the California Department of Forestry and Fire Protection, the state has suffered the most wildfires in recent history, with the Tubbs fire in October 2017 (near Napa) killing 22 people and destroying more than 5,600 buildings.

The fires have affected more than 1,000 residents and resulted in more than $7.5 billion in damages. Given the situation, sustainable building and home owner insurance in California have never been more relevant.

Climate Change Impact on Homeowners

Now that we’ve highlighted a few noteworthy solutions, let’s explore how climate change may impact you as a homeowner.

Increased Homeowner Expenses

According to research from the Public Policy Institute of California, the rising sea levels and coastal floods could wipe out $580 billion in property value. That’s a lot of money that homeowners will be forced to part with if they don’t get quality coverage from homeowners insurance companies in California. Ultimately, the financial risks pale in comparison to the life-threatening dangers that lie in wait.

How does this influence fees? The homeownership rate in California is among the highest in the country. Some homeowners shell out more than $2,000 in insurance yearly. And, those rates are still on the rise as the insurance companies pass on the increased costs of claims and litigation. High renovation costs in these locations have also created an uptick in housing market prices, which shows no sign of slowing down soon.

Increased Chance of Unfavorable Weather Conditions

While there are still some uncertainties surrounding the cause of global warming, it’s clear that climate change increases the frequency and severity of extreme weather events like hurricanes, wildfires, and floods. Unfortunately, a large portion of the property in the state of California falls under the category of at-risk areas.

For homeowners, the increased risk could translate to significant damage to property and high insurance premiums in the long run. If you own a home in California or anywhere else, get a home insurance policy that will protect your home from weather-related damage and other damages caused by natural disasters. The average cost of homeowners insurance in California is $107 per month.

Reduced Indoor Air Quality

Living in a wildfire-prone area can also cause problems with indoor air quality. Smoke and soot from the raging fire can get into your home and cause respiratory problems, headaches, and other health issues. If you live in a wildfire-prone area, it’s important to take steps your home’s indoor air quality. To do this, install an air filter, close your windows and doors, and refrain from smoking inside.

You can get the best homeowners insurance California has to offer to reduce your risk of indoor air quality problems, and here’s where it comes in handy. If your home is damaged by a natural disaster, you and your family may be exposed to toxic materials that pollute the indoor air. Thus, you’re left with no choice but to evacuate. Getting coverage from any of the top home insurance companies in California will help you pay for your home repair costs, which will, in turn, lead to improved indoor air quality.

Lack of Available Housing

As a result of the increased climate change risks, California is suffering from a housing shortage. As the demand for houses continues to increase, the supply of homes has been steadily declining. Although the issue is far from resolved, it seems that policymakers are finally taking note.

In the wake of the California wildfires that destroyed hundreds of houses and structures and killed dozens of people in the state, local politicians are now talking about building regulations, which would ensure that any development project can withstand damage from wildfires.

If you’re looking to purchase a house in California, know that the state ranks 49th in terms of housing supply. This, coupled with the state’s stringent building requirements and rising home prices, may be cause for concern for would-be homebuyers. This is also why it is important to consider top homeowners insurance in California and their roles in mitigating the risk of a natural disaster.

Conclusion

The impact of climate change is evident in California. And, the only way to get ahead of the trend is to get adequate insurance coverage from homeowners insurance companies in California. We all have a stake in this fight. Let’s join forces to ensure that our homes and our loved ones remain safe from the adverse effects of climate change.